Overview

MGI Research created and tracks the MGI Cloud 30 Index (established in 2009), a proxy for the performance of technology companies likely to benefit disproportionately from adoption of cloud computing. The index (Bloomberg: MGICLOUD), has demonstrated that cloud computing is a significant, distinct, and durable multi-year trend that has produced definitive winners and losers.

Index positions are revenue, not market cap, weighted. Companies need to demonstrate meaningful contribution of cloud computing revenue components in terms of percentage of overall revenue, critical mass of revenue, and revenue growth. We continue to monitor the industry metrics of all leading cloud computing participants.

Index Composition

MGI Cloud 30 Index is comprised of shares of 30 US-listed companies that have the most direct and meaningful exposure to cloud computing. It includes cloud companies in IaaS, PaaS, SaaS, and related tools and infrastructure.

Example Companies

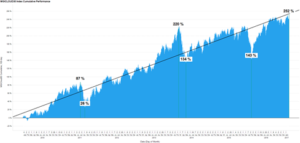

Historical Performance Snapshot

Over a period from Dec 21, 2009 to Feb 10, 2017, a model portfolio of MGI Cloud 30 Index equities has cumulatively returned over 252% (see Fig. 1 below) vs. about 108% for the S&P500 benchmark during the same period.

DISCLAIMER: The information presented here is not an offering or a recommendation to buy or sell any securities in any market and does not represent investment advice in any form.